Earn 14% rewards with Akash Network Staking

4 steps to get your AKT rewards

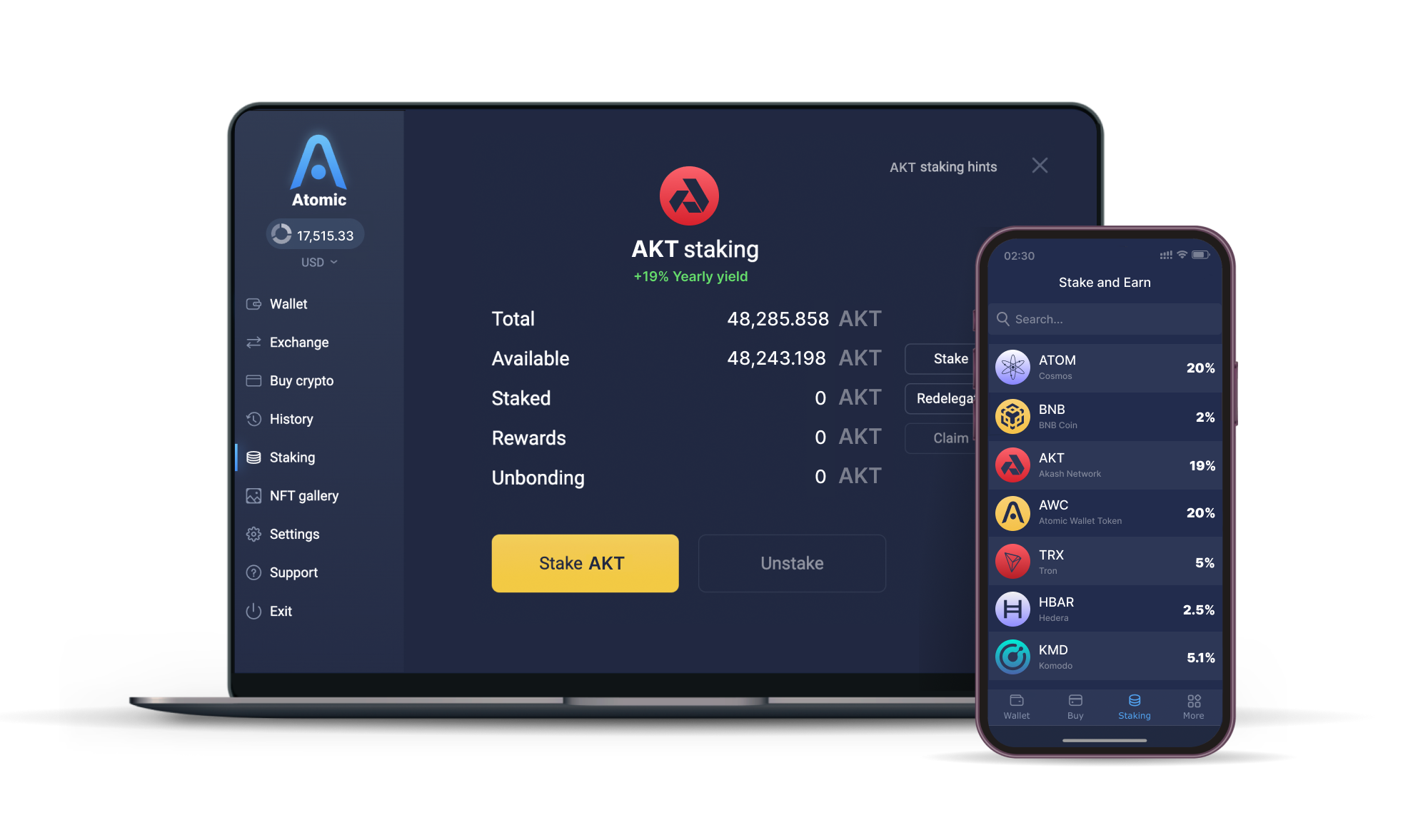

Get wallet

Install the app on your system

Deposit crypto

Deposit AKT to your account

Stake crypto

Choose a validator and stake AKT

Claim Rewards

You will get rewards automatically to your staking address.

Introduction to Akash Network

Akash Network is a decentralized cloud computing platform that aims to provide a more efficient and cost-effective solution for cloud infrastructure. Built on the Tendermint consensus algorithm, Akash leverages blockchain technology to create a decentralized marketplace for computing resources.

By utilizing the Akash Network, users can access cloud computing resources from a global pool of providers, allowing for greater flexibility and scalability. This decentralized approach eliminates the need for intermediaries and reduces costs, making it an attractive option for developers and businesses.

Benefits of Staking AKT

Staking AKT, the native cryptocurrency of the Akash Network, offers several benefits to participants in the network. Staking involves holding AKT tokens in a designated wallet and participating in the consensus mechanism of the blockchain.

One key benefit of staking AKT is the opportunity to earn staking rewards. At Genesis, the initial inflation rate for staking rewards on the Akash PoS network is set at 54% APY. However, it's important to note that the inflation rate gradually decreases each month, halving every 3.75 years to ensure the longevity and security of the Akash blockchain.

In addition to earning passive income, staking AKT also plays a vital role in enhancing the security of the network. By staking their tokens, participants contribute to the consensus process and help to validate transactions on the blockchain. This decentralized validation mechanism strengthens the network and protects it from potential attacks.

Furthermore, AKT holders have the power to participate in the governance of the Akash Network. They can vote on proposals to improve the network and manage critical parameters, such as inflation rate and take rates. This democratic governance structure ensures that all aspects of the network are governed by AKT holders, fostering a community-driven approach to decision-making (Akash Network).

Additionally, AKT serves as a default mechanism to store and exchange value within the Akash Network. It acts as a reserve currency in Cosmos’ multi-currency and multi-chain ecosystem, providing stability and utility to the network (Akash Network).

To participate in staking AKT and enjoy these benefits, users can explore the tools and resources offered by the Akash Network. These tools facilitate tasks such as exploring the blockchain, staking AKT, participating in governance, and earning staking rewards (Akash Network).

By understanding the fundamentals of the Akash Network and the advantages of staking AKT, users can make informed decisions about their participation in this innovative blockchain ecosystem.

Akash Staking Overview

To fully understand the benefits and potential of AKT staking on the Akash Network, it is important to explore the staking rewards and inflation rate, as well as the governance and network security aspects.

Staking Rewards and Inflation Rate

At Genesis, the initial inflation rate for staking rewards on the Akash Proof-of-Stake (PoS) network is set at 54% Annual Percentage Yield (APY) Medium - Stakin. However, this inflation rate gradually decreases each month and halves every 3.75 years to ensure the longevity and security of the Akash blockchain.

It's important to note that the actual reward rate for staking on the Akash network is subject to change based on the current block time, total staked amount, and transaction fees. According to Staking Rewards, the reward rate is currently - (to be updated with the most recent data). By regularly claiming rewards, ideally once daily to weekly, stakers can maximize their staking rewards and take advantage of compounded rewards Staking Rewards.

Governance and Network Security

Staking AKT not only provides a passive income stream for stakers but also plays a crucial role in the governance and security of the Akash Network. AKT holders have the power to vote on proposals to improve the network and manage critical parameters like the inflation rate and take rates, ensuring that all aspects of the network are governed by the AKT holders Akash Network.

Furthermore, AKT acts as the default mechanism for storing and exchanging value within Cosmos' multi-currency and multi-chain ecosystem. It plays a vital role as a reserve currency, supporting the overall stability and functionality of the Akash Network Akash Network.

To mitigate risks and maintain network security, it is crucial to carefully select a reliable and professional Validator when staking AKT. Validators play a key role in maintaining the network's integrity and ensuring that they do not miss blocks or engage in any activities that could compromise the network. By delegating AKT to trusted Validators, stakers can minimize the risks associated with slashing (Staking Rewards).

In summary, AKT staking offers a unique opportunity for crypto enthusiasts to earn passive income while actively participating in the governance and security of the Akash Network. By staying informed about the staking rewards, inflation rate, and selecting reputable Validators, stakers can make informed decisions to maximize their earnings and contribute to the growth and stability of the Akash ecosystem.

How to Stake AKT

Staking AKT on the Akash Network provides a passive income stream for stakers while increasing the security of the network (Akash Network). Here is a step-by-step guide to help you navigate the process of staking AKT and maximize your staking rewards.

Staking Process Step-by-Step

Acquire AKT Tokens: To stake AKT, you need to acquire the AKT tokens. You can purchase AKT from various cryptocurrency exchanges.

Choose a Wallet: Select a compatible wallet that supports AKT staking. Some popular options include Keplr, Ledger, and Cosmostation.

Set Up Your Wallet: Follow the instructions provided by your chosen wallet to set up and secure your wallet. Make sure to keep your private keys or seed phrase safe.

Connect Your Wallet: Connect your wallet to the Akash Network platform. This will allow you to interact with the network and stake your AKT tokens.

Delegate AKT: Delegate your AKT tokens to a validator of your choice. Validators play a crucial role in securing the network and validating transactions. You can find a list of validators on the Akash Network website.

Choose a Validator: Research and select a validator based on factors such as their reputation, commission fees, and performance. It's important to choose a reliable validator to ensure the safety of your staked AKT.

Delegate Your AKT: Delegate your AKT tokens to your chosen validator through your connected wallet. This process may vary depending on the wallet you are using, but it generally involves selecting the validator and specifying the amount of AKT you want to delegate.

Confirm Delegation: Review the transaction details and confirm the delegation. Once the transaction is confirmed, your AKT tokens will be staked with the chosen validator.

Maximizing Staking Rewards

To maximize your staking rewards on the Akash Network, consider the following tips:

Choose a High-Quality Validator: Select a validator with a good track record, low commission fees, and high uptime. Validators with a strong reputation are more likely to provide reliable services and generate consistent rewards.

Stay Informed: Stay updated on the latest news and developments related to the Akash Network. This will help you make informed decisions regarding your staking strategy and potential changes to network parameters.

Monitor Performance: Regularly monitor the performance of your chosen validator. Keep an eye on their uptime, commission fees, and rewards distribution. If you notice any significant changes or issues, consider re-delegating your AKT to a different validator.

Consider Staking Periods: Some validators offer different staking periods, such as short-term or long-term options. Evaluate the benefits and risks associated with each staking period and choose the one that aligns with your investment goals.

Diversify Your Stakes: Consider diversifying your AKT stakes across multiple validators. This can help mitigate risks and maximize your overall staking rewards.

Remember that staking involves risks, and it's important to do your own research and consult with professionals before making any investment decisions. For more information on AKT staking rewards and the governance of the Akash Network, visit our article on akash staking rewards.

Risks and Considerations

When engaging in Akash staking, it's important to be aware of the potential risks and considerations involved. This section will highlight two key aspects: slashing risks and validators, as well as the withdrawal period and claiming rewards.

Slashing Risks and Validators

By delegating AKT for staking, there is a risk of slashing if the validator misses blocks or attempts to corrupt the network. Slashing refers to a penalty imposed on stakers for such actions. To mitigate these risks, it is crucial to select a reliable and professional validator (Staking Rewards). Choosing a reputable validator helps ensure that your staked AKT remains secure and that the network functions efficiently.

When selecting a validator, it's essential to consider their track record, reputation, and the level of security they offer. Look for validators who actively participate in the governance of the Akash Network and have a strong commitment to network security. By delegating your AKT to trusted validators, you can minimize the likelihood of experiencing slashing risks and protect your staking rewards.

Withdrawal Period and Claiming Rewards

When staking AKT, it's important to understand the withdrawal period and the process of claiming rewards. The withdrawal period for staked AKT is 21 days, during which your funds remain locked in the staking contract. It's crucial to factor in this timeframe when considering the liquidity of your staked AKT.

To maximize your staking rewards, it is advisable to claim rewards regularly. Ideally, rewards should be claimed at a frequency ranging from once daily to weekly. By claiming rewards, you can reinvest them by manually claiming and delegating them again, allowing for the highest rate of compounded rewards (Staking Rewards). This proactive approach helps optimize your earnings and ensures that you are making the most of your staked AKT.

By understanding the risks associated with slashing and selecting trustworthy validators, as well as being aware of the withdrawal period and the importance of claiming rewards regularly, you can navigate the world of Akash staking more confidently. It's always recommended to stay informed and up to date with the latest developments and best practices in AKT staking to make informed decisions and maximize your staking rewards.

Akash Network Applications

As the Akash Network continues to gain recognition in the cryptocurrency and blockchain space, it's important to explore the various applications and partnerships that contribute to its growing ecosystem.

Use Cases of AKT Staking

Staking the AKT token plays a vital role in the Akash Network ecosystem. By staking AKT, users can actively participate in the network and contribute to its security and governance. Some of the primary use cases of AKT staking include:

Deploying Decentralized Applications (dApps): Staking AKT allows developers to deploy their dApps on the Akash Network. This enables them to leverage the network's decentralized cloud infrastructure, benefiting from its scalability and reliability. By staking AKT, users not only support the network but also gain exposure to potential rewards.

Participating in Governance Voting: AKT stakers have the opportunity to participate in the governance of the Akash Network. They can vote on proposals and decisions that shape the future of the network, such as protocol upgrades and parameter adjustments. Staking AKT gives users a voice in the decision-making process.

Securing the Network: Staking AKT helps secure the Akash Network by participating in the Proof-of-Stake (PoS) consensus mechanism. Stakers validate transactions and secure the network against potential attacks. In return for their contribution, stakers have the potential to earn staking rewards, which incentivizes active participation and network security.

Akash Network Partnerships

The Akash Network has formed strategic partnerships with various projects and organizations, contributing to its growth and expansion. These partnerships are instrumental in establishing Akash as a premier Web3-native cloud platform. Here are a few notable partnerships:

Brev.dev: Brev.dev leverages Akash Network's permissionless GPU infrastructure to seamlessly scale their operations. By utilizing the network's resources, Brev.dev can offer scalable solutions and insights into how Akash enables scalability for different applications (Akash Network).

Overclock Labs and ThumperAI: Overclock Labs and ThumperAI have utilized Akash GPUs to train a foundation AI model. This collaboration showcases the network's capability in supporting AI model training processes, further highlighting the versatility of the Akash Network.

Circle: Akash Network was recognized by the co-founder of Circle for pioneering decentralized cloud infrastructure as a service, offering a globally available, programmable settlement currency in the form of USDC. This partnership highlights Akash's ability to provide innovative solutions in the blockchain and cloud computing space (Akash Network).

Web3 Infrastructure Projects: Akash Network has partnered with various Web3 infrastructure projects to enable developers to build full-stack decentralized applications. These partnerships enhance Akash's position as a premier Web3-native cloud platform, providing developers with the necessary tools and resources to create robust decentralized applications.

As the Akash Network continues to forge new partnerships and expand its network, the potential for innovative applications and collaborations within the ecosystem grows. These partnerships contribute to the overall development and adoption of the Akash Network, showcasing its market potential and unique features.

Market Analysis and Future Outlook

When considering investments in the cryptocurrency market, it's important to analyze the market capitalization and potential of the specific token. In the case of AKT, the market capitalization of Akash Network is currently valued at $1.02 billion with a circulating supply of approximately 235.12 million AKT tokens Bitcompare.

It's worth noting that the price of AKT is subject to market fluctuations. As of the latest data, the current price of AKT stands at $3.87 with a 24-hour trading volume of $15.16 million and a 9.42% decrease in value over the past 24 hours Bitcompare. Investors should always exercise caution and conduct thorough research before making any investment decisions.

One of the unique features of Akash Network is its staking model, which enables developers to access cloud compute at a cost that is 2x-3x lower than centralized cloud providers Bitcompare. This advantage contributes to the acceleration of adoption through containerization technology, providing a more cost-effective solution for developers.

By integrating containerization technology with a unique staking model, Akash Network aims to revolutionize the cloud computing industry. The network operates on a proof-of-stake consensus mechanism, allowing users to stake AKT tokens to secure the network and earn rewards Bitcompare. This approach creates a more efficient and cost-effective cloud computing ecosystem through peer-to-peer transactions.

The self-sovereign nature of Akash Network, along with its censorship resistance and permissionlessness, establishes it as a groundbreaking solution in the cloud computing industry Bitcompare. This innovative approach benefits individual users, data centers, and high-demand industries like DeFi, machine learning, and AI by offering lower costs compared to centralized cloud providers.

As the market evolves, Akash Network has the potential to gain further traction and expand its user base. With its focus on efficiency, cost-effectiveness, and security, Akash Network is well-positioned to address the growing demand for cloud computing solutions. The future outlook for AKT and Akash Network remains promising, attracting attention from crypto enthusiasts and investors alike.

In conclusion, the market analysis of AKT reflects its current market capitalization and price. The unique features and potential of Akash Network, along with its innovative staking model, contribute to its attractiveness within the crypto market. However, as with any investment, it's important to conduct thorough research and stay informed about market trends before making any financial decisions.