Assets

Exchange

Buy Crypto

Products

With the Base network growing into a premier Ethereum Layer 2 at breakneck speed, Aerodrome has emerged as the decentralized finance (DeFi) hub of choice on the chain. As a next-gen automated market maker (AMM), Aerodrome is more than just a DEX—it's the liquidity foundation of Base.

Aerodrome enables tokenless exchanges, deep liquidity provision, and onchain governance that allows users to direct incentives where needed the most. Its success is tested with its consistent number-one position on revenue, total value locked (TVL), and trading volume on Base.

Aerodrome Finance is a natively developed, decentralized exchange and liquidity platform on Base blockchain. Derived from Velodrome V2, Aerodrome suggests a vote-escrow method and dynamic incentive alignment for protocols and liquidity providers.

With focus on reducing fragmentation of liquidity and keeping users in control of token emissions, Aerodrome is a programmatic DeFi marketplace where aligned incentives drive ecosystem growth.

Aerodrome is a standard AMM protocol. Users can:

Unlike traditional DEXs, Aerodrome allows token lockers (veAERO holders) to vote every week on which pools are rewarded with AERO emissions, aligning liquidity incentives with community governance.

The AERO token powers the Aerodrome ecosystem.

When AERO is locked, users receive veAERO—a vote-escrowed token that provides voting power. Voting determines which pools will receive future rewards, i.e., AERO is not just a speculative tool, but a way to have an influence on the economic flows of the protocol.

Upon locking AERO tokens, user receives veAERO.

Such a mechanism allows to channel the emissions towards the most active and beneficial parts of the ecosystem and, at the same time, encourage long-term alignment.

Liquidity providers in Aerodrome are incentivized in a number of ways. If their liquidity is unstaked, they receive swap fees for their active liquidity funding trades. If unstaked, they receive AERO emissions as directed by veAERO voters.

Protocols often incentivize these votes with extrinsic rewards called bribes. This means that liquidity farming is a competitive dynamic where projects and token holders compete for the attention of governance, resulting in an efficient and competitive incentive structure.

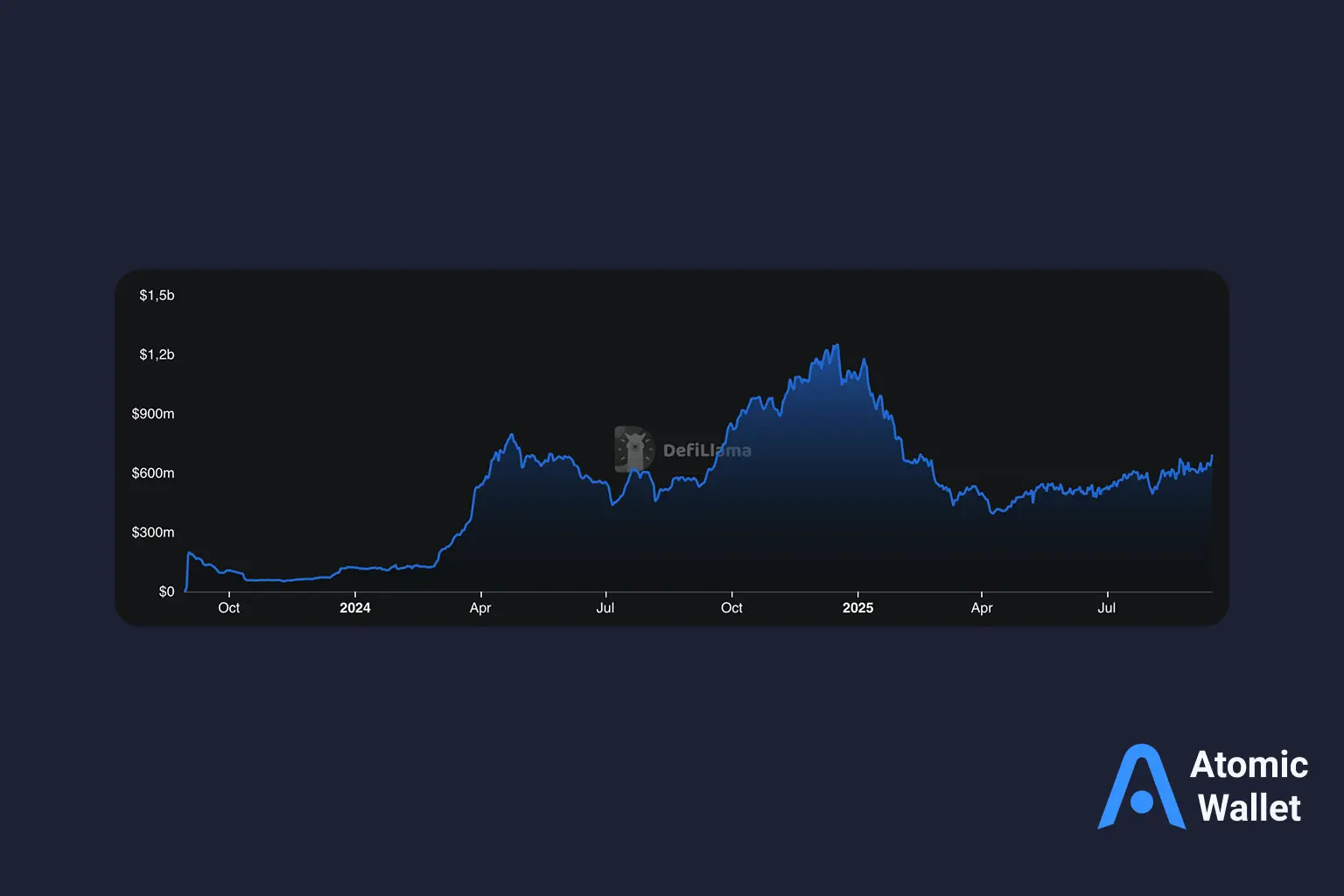

Aerodrome has since launching:

Its growth is a sign of Base increasing as a legitimate Ethereum L2 and Aerodrome's status as its core layer of liquidity.

Aerodrome benefits from legacy Velodrome V2 codebase, which is already audited by established security firms. Its contracts are open-source, encouraging transparency and peer inspection.

Nevertheless, as with any DeFi protocol, there are risks. Users are exposed to potential impermanent loss, smart contract flaws, and governance centralization. Risk is lessened by audits, but not eliminated. Prudence and suitable research are always advised when dealing with smart contracts.

The Aerodrome team is also actively building the platform with future concepts to expand user experience, add more analytics tools, and integrate with other DeFi applications on Base. Future developments include enhanced bribe markets, cross-chain, and more governance modules.

Aerodrome, as Base scales, will also be a building block cornerstone, not just as a DEX, but as a whole liquidity and governance layer for the entire system.

Aerodrome is organically built for the network and architected specifically to pool liquidity, as opposed to other Base DEXs such as Uniswap or SushiSwap.

Uniswap and Sushi use old AMM architectures with protocol-led emissions. Aerodrome outsources that power to users in the form of veAERO. Its system favors long-term orientation, better liquidity depth, and broader ecosystem incentives.

RocketSwap, another Base DEX, lacks the user-driven emission model and governance richness, which is a massive advantage for Aerodrome in terms of incentive optimization and flexibility.

Aerodrome benefits from legacy Velodrome V2 codebase, which is already audited by established security firms. Its contracts are open-source, encouraging transparency and peer inspection.

Nevertheless, as with any DeFi protocol, there are risks. Users are exposed to potential impermanent loss, smart contract flaws, and governance centralization. Risk is lessened by audits, but not eliminated. Prudence and suitable research are always advised when dealing with smart contracts.

Aerodrome is the focal point of Base's DeFi stack. Its governance-centric design, optimized AMM mechanics, and integration into the Base ecosystem set it apart as a mere trading platform—it is the capital coordination layer of the network.

As the Base expands and adoption grows, Aerodrome will likely be a key player in routing liquidity, determining incentives, and allowing users to control DeFi infrastructure at scale.

What is Aerodrome?

Aerodrome is a native Base decentralized exchange and liquidity coordination protocol.

How can I receive rewards on Aerodrome?

Provide liquidity to trading pools and earn swap fees. Lock AERO tokens to get voting power and take part in emissions.

What is veAERO?

veAERO is a governance token earned through locking up AERO. It allows users to vote for which pools are rewarded.

Is Aerodrome audited?

Yes. The codebase was inherited from Velodrome and has been audited. There are further audits and bug bounties underway.

May I use MetaMask?

Yes, Aerodrome supports MetaMask, Coinbase Wallet, and other Base-compatible wallets.

DigiDollar is a decentralized USD stablecoin built on DigiByte, using time-locked overcollateralized DGB for non-custodial liquidity. Now on testnet.

Explore the most active and profitable Polymarket categories in 2026. Learn how politics, sports, crypto, AI, and macro markets differ by liquidity, volatility, and risk — and why category choice matters as much as prediction.