Assets

Exchange

Buy Crypto

Products

DoubleZero's mainnet-beta launch has already created ripples across Web3's infrastructure layer. Characterized as a "bandwidth-first" blockchain network, DoubleZero comes as a next-gen Layer-0 that aims to solve one of crypto's most underappreciated problems — secure coordination and communication between chains and validators.

DoubleZero's popularity increased after its $28 million capital raise from Multicoin Capital and Dragonfly, accompanied by a rare "no-action" letter from the SEC, allowing the team to sell the 2Z token in the United States without facing a challenge of immediate enforcement. The combination of funding, regulatory clarity, and functional mainnet-beta has put DoubleZero at the center of the L1/L0 narrative.

Over another interoperability step, the project is providing a high-throughput layer of communication for decentralized systems, likened by some analysts to "a fiber-optic Internet layer for blockchains."

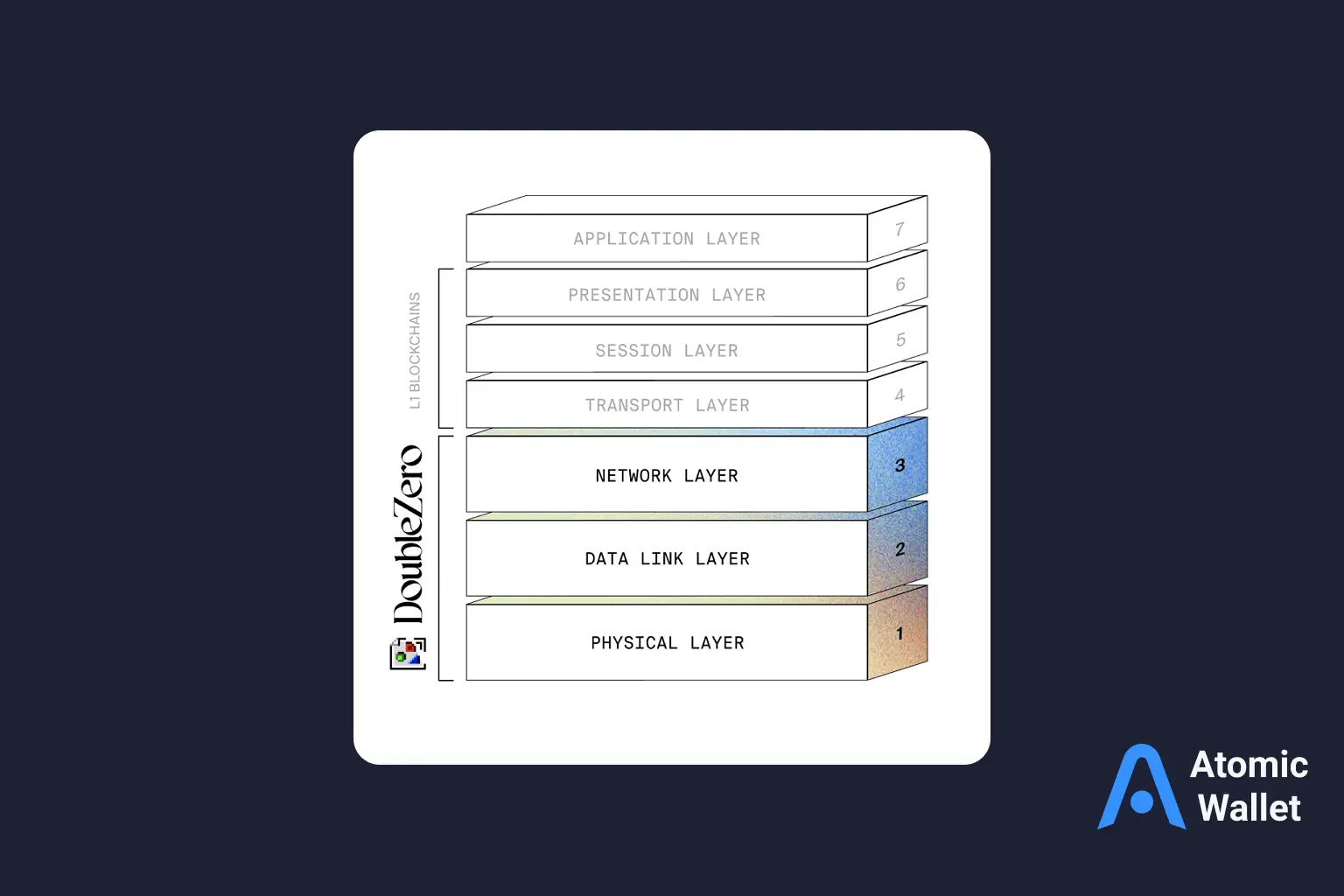

Effectively, DoubleZero (2Z) is more than another execution chain, but a coordination network — intended to handle validator-to-validator communication, message propagation, and proof transfer across various blockchains. The company calls it an "N1 protocol," meaning it operates under Layer-1 chains to connect them through a specialized fiber-based data layer.

This design is low-latency, bandwidth-verifiable, and cross-chain message integrity — the building blocks needed for reliable settlement between blockchains, or between concurrent-deployed decentralized applications.

While most L0 solutions are single-mindedly focused on bridging or restaking, DoubleZero aims to build the backbone itself: high-capacity routing nodes, optimized consensus messaging, and off-chain coordination with on-chain finality proofs.

It's infrastructure for infrastructure — a system that attempts to make other blockchains speedier, safer, and more in sync.

From a technical standpoint, DoubleZero combines communication nodes specifically designed for communication, proof relays, and bandwidth staking into a combined architecture.

Here’s what that means in practice:

This mechanism turns DoubleZero more into an Internet Service Layer for blockchains rather than a conventional L1. It scales coordination, not computation.

The 2Z token underpins network economics and governance. Its core functions include:

This design gives 2Z two demand drivers — operational (bandwidth usage) and speculative (staking reward + governance) — to make it a utility backbone rather than a purely transactional token.

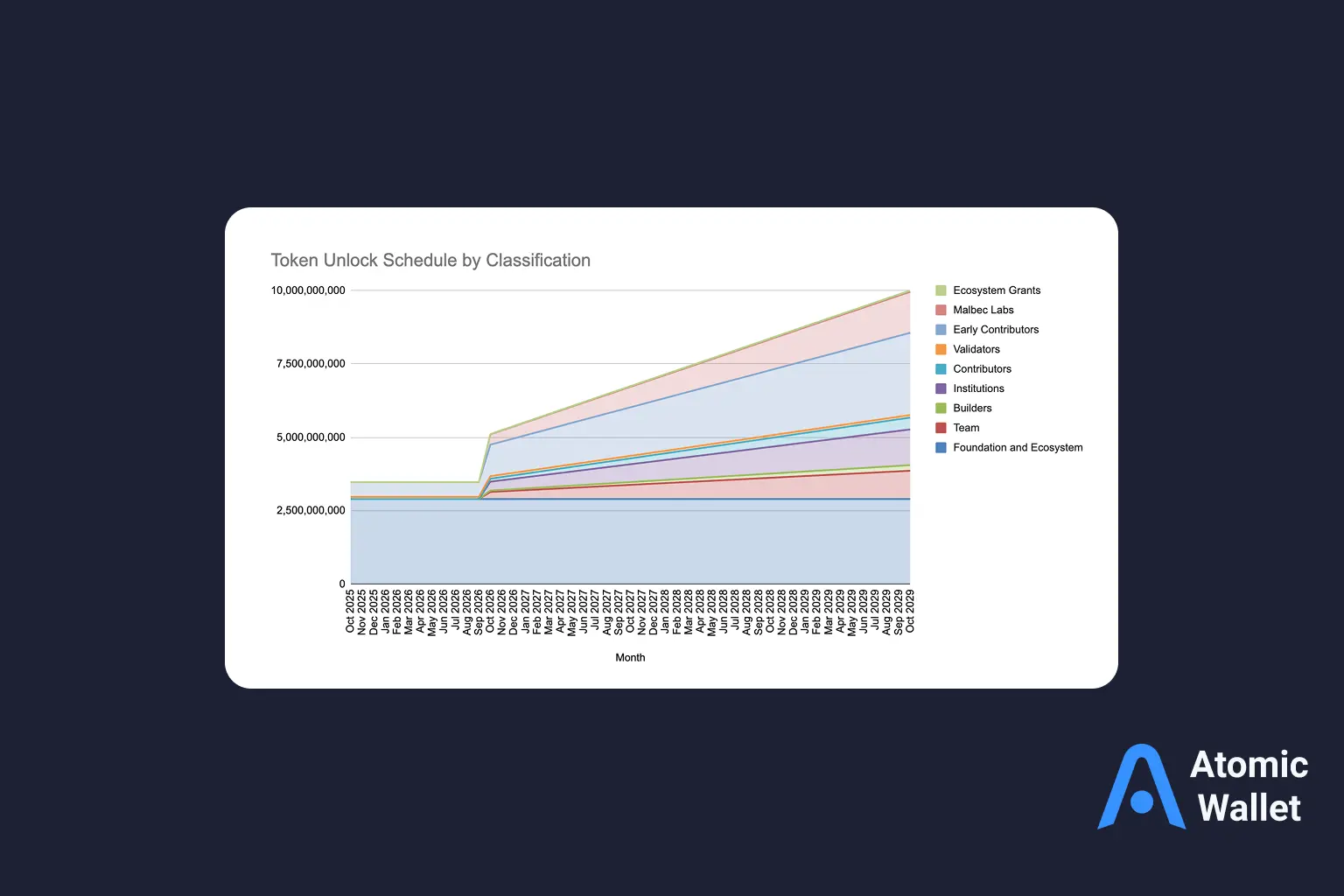

Public materials and filings outline preliminary tokenomics, though parts remain not disclosed:

The team explicitly states no retail sale and centralized-exchange listing until mainnet-stable, pointing towards validator-driven distribution in the early stage.

DoubleZero is running in Mainnet-Beta mode as of October 2025 — an operational phase where consensus and validator clusters are fully live but governance parameters and incentive schedules are still being fine-tuned.

Recent milestones include:

Roadmap ahead:

The team publishes milestones publicly in the form of GitHub commits and verified Medium posts — an encouraging sign for an early Layer-1.

DoubleZero's ecosystem is expanding quickly, with developers probing how bandwidth staking interacts with existing DeFi and cross-chain capability.

Key integrations to date include:

Developers already get to experiment with test SDKs to build "bandwidth-aware" dApps — apps that scale throughput needs automatically based on staked 2Z.

It's an unusual but heartening design approach: banding together bandwidth as a resource like gas.

Right now, 2Z tokens are mainly distributed through validator rewards and small community airdrops tied to Mainnet-Beta participation.

If you’re looking to acquire or hold 2Z, follow a few simple steps to stay safe:

Manage your 2Z and other modular L1 tokens in one place — with full ownership of your keys. Atomic Wallet supports 2Z storage and swaps once the token reaches open trading phase. Download Atomic Wallet and keep your DoubleZero tokens self-custodied from day one.

DoubleZero Mainnet-Beta staking has a light model with focus on speed and early decentralization. Validators stake 2Z tokens to stake the network and allocate "bandwidth shares," which determine how much throughput they can validate.

For validators:

For delegators:

Governance:

Staked 2Z owners can vote on proposals via an on-chain portal. Governance decisions include validator admittances, fee rate changes, and development-fund allocation.

The ethos is to progress towards a DAO-governed, self-sustaining Layer-1, balancing validator incentives with community direction

Even new Layer-1s with exceptional potential come with strings attached. Before buying or staking 2Z, consider:

Protocol Risk: Mainnet-Beta software still evolves; bugs or consensus stalls remain possible. Always stake modestly in initial phases.

Token & Market Risk: Circulating supply and emissions data remain limited. Price discovery can be superficial on new DEX pairs, encouraging volatility.

Operational Risk: Bridges and cross-chain modules are actively being worked on. Treat them as experimental until security audits are fully published.

Regulatory Risk: Since DoubleZero involves payment rails, regulation can expand by jurisdiction.

Practical tips: Employ verified smart contracts, avoid using leverage on illiquid tokens, and self-custody all assets — particularly in beta stages.

What is DoubleZero?

DoubleZero is a next-generation Layer-1 blockchain designed for modular scalability. It separates compute, bandwidth, and consensus layers to enable faster, verifiable cross-chain communication.

Is DoubleZero Mainnet live?

Yes — the Mainnet-Beta launch went live in October 2025. It marks the project's transition from testnet to live, production-grade environment with validator staking and native token utility.

What is the 2Z token used for?

2Z powers transactions, validator staking, and governance voting. It also represents bandwidth allocation for performing transactions in the DoubleZero network.

How can I earn with 2Z?

You may stake 2Z as a validator or delegate to earn block rewards and transaction fees. The early adopters will also likely receive ecosystem incentives distributed through official channels.

Is 2Z compatible with existing wallets?

Yes — DoubleZero is integrated into leading non-custodial wallets such as Atomic Wallet, MetaMask (with custom RPC), and Trust Wallet. Always validate network parameters before sending assets.

How secure is DoubleZero?

The network uses a bandwidth-staked BFT consensus framework. Independent audits are underway, and the team provides transparency reports as new modules go live.

Learn what Aztec Network is, how its privacy Layer 2 works, and what the AZTEC token launch means. Explore AZTEC staking, programmable privacy, and how Aztec differs from other Ethereum L2s.

DigiDollar is a decentralized USD stablecoin built on DigiByte, using time-locked overcollateralized DGB for non-custodial liquidity. Now on testnet.

Explore the most active and profitable Polymarket categories in 2026. Learn how politics, sports, crypto, AI, and macro markets differ by liquidity, volatility, and risk — and why category choice matters as much as prediction.