Assets

Exchange

Buy Crypto

Products

Prediction markets just hit a new milestone: Kalshi — the only CFTC-regulated prediction exchange in the U.S. — has gone onchain via Solana. Every market on Kalshi can now exist as a tradeable Solana token, giving users, builders, and liquidity providers access to regulated event outcomes inside one of the fastest ecosystems in crypto.

This moves prediction markets from isolated, web-only contracts to fully composable onchain assets — and that fundamentally changes what can be built on top of them.

Kalshi is the first federally regulated event-contract exchange, approved by the U.S. Commodity Futures Trading Commission (CFTC). It lets users trade on real-world questions — inflation prints, elections, rate decisions, weather, sports — with institutional-grade liquidity and compliance.

Unlike platforms like Polymarket, Kalshi operates as a regulated financial exchange, which is why the integration with Solana is so impactful: it brings legally recognized, fully compliant markets directly into Web3 for the first time.

Kalshi’s markets are no longer trapped inside a single, closed exchange interface. Through the new integration, every prediction market on Kalshi can now be expressed as a native token on Solana and traded like any other onchain asset.

In practice, it means:

Instead of prediction markets being an isolated vertical, they become part of the broader Solana liquidity graph: swappable on DEXs, usable in vaults, index products, structured strategies, or even inside consumer apps and AI agents.

Prediction markets work best when they are fast, cheap, and reactive. Solana gives Kalshi exactly that: millisecond-level finality, extremely low fees, and an ecosystem already tuned for high-frequency trading, perps, and orderflow-based infrastructure. It’s a natural fit for markets that move in lockstep with news, macro data, and sentiment.

As Solana continues to mature with institutional-grade improvements like Firedancer and deeper market-making activity from firms such as Jump, it is increasingly positioned as a real-time settlement layer for financial applications. Plugging regulated event contracts into that environment turns Solana from “just another DeFi chain” into a live venue for trading the future itself.

DFlow is the technical bridge that makes this integration possible. It takes Kalshi’s regulated event markets and mirrors them on Solana in a way that preserves liquidity, pricing, and redemption logic — without compromising the underlying compliance framework.

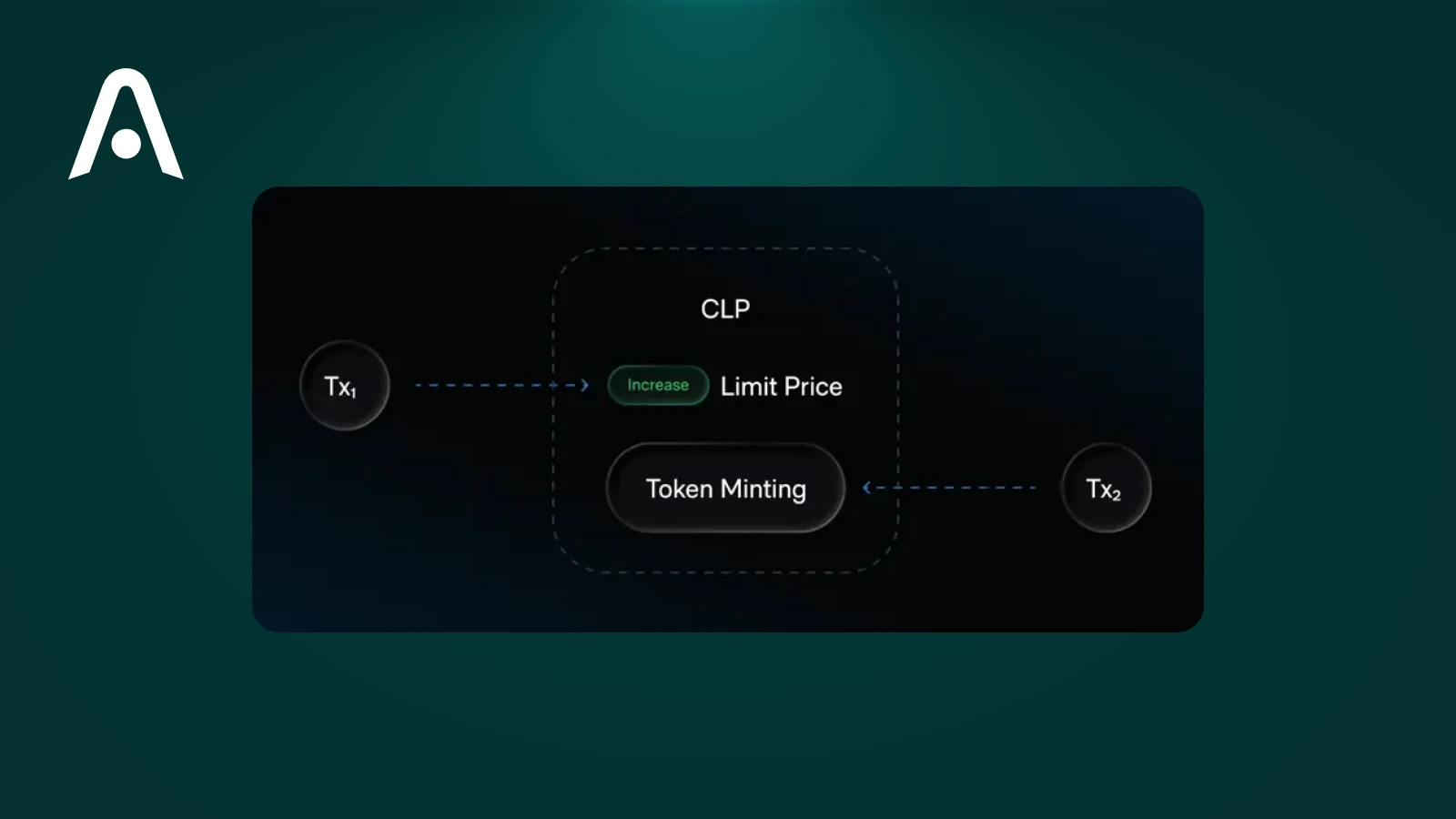

At the core is DFlow’s Concurrent Liquidity Programs (CLPs), a Solana-native mechanism designed for syncing offchain liquidity with onchain traders:

CLPs remove the historical bottleneck — prediction markets couldn’t scale globally because liquidity lived offchain, while traders were onchain. Now the two operate in parallel, giving prediction markets real depth and real composability for the first time.

Kalshi and Polymarket often get lumped together, but they sit on opposite ends of the spectrum.

Both ecosystems grow prediction markets — but in completely different ways. Kalshi finally brings legality and institutional-grade certainty into the same world where DeFi users already thrive.

Tokenized Kalshi outcomes instantly become building blocks across Solana. Instead of being locked inside a closed exchange, they can move, trade, and compose like any other asset. Developers and traders gain an entirely new class of primitives.

Some of the most powerful use cases:

By turning predictions into programmable tokens, Kalshi unlocks one of the broadest new design spaces since RWAs entered DeFi.

For builders, this is the first time regulated event markets become a fully accessible onchain asset class. Instead of scraping data or simulating odds, developers can plug directly into real market liquidity.

Key advantages:

Building on top of regulated market liquidity was impossible until now. This launch makes it trivial.

For traders, tokenized Kalshi markets turn “opinions about the future” into liquid instruments you can actually position around. Instead of just trading BTC or SOL around macro events, you can take direct, binary or multi-outcome exposure to the events themselves: CPI prints, rate decisions, elections, weather shocks, sports results.

This opens up new strategies: hedging directional risk with event outcomes, running arbitrage between offchain Kalshi pricing and onchain Solana markets, or building portfolios that mix spot, perps, and event contracts in a single stack.

First, you secure regulatory approval. Then institutions feel comfortable providing capital. Only after that do prediction markets become more than a niche toy.

Bringing that model onto Solana means DeFi finally gains access to regulated, institutionally funded event liquidity. It’s not another synthetic or unregulated side product — it’s the same Kalshi markets that banks, funds, and professional traders can legally touch, now living as tokens inside a high-performance L1. That is a fundamentally different starting point than most onchain prediction experiments.

This integration is bigger than just “Kalshi is on Solana now.” It’s one of the clearest bridges between traditional, regulated market structure and the composability of Web3. Event contracts move from being a closed, regulated silo into an onchain format that any wallet, protocol, or app can integrate.

DeFi Summer showed what happens when spot and leverage go fully programmable. RWAs showed how bonds and treasuries behave when they enter the same world. Tokenized Kalshi markets are a similar unlock for prediction markets: they turn the future itself into an asset class that Web3 can build on.

If you’re planning to trade prediction-linked assets, farm yield around stablecoins, or simply hold SOL and other ecosystem tokens, self-custody is the safest base layer to operate from.

Atomic Wallet lets you:

Prediction markets are getting more sophisticated and more integrated with DeFi. Your custody setup should be just as robust.

Learn what Aztec Network is, how its privacy Layer 2 works, and what the AZTEC token launch means. Explore AZTEC staking, programmable privacy, and how Aztec differs from other Ethereum L2s.

DigiDollar is a decentralized USD stablecoin built on DigiByte, using time-locked overcollateralized DGB for non-custodial liquidity. Now on testnet.

Explore the most active and profitable Polymarket categories in 2026. Learn how politics, sports, crypto, AI, and macro markets differ by liquidity, volatility, and risk — and why category choice matters as much as prediction.