Assets

Exchange

Buy Crypto

Products

PayPal USD (PYUSD) is a US dollar-pegged stablecoin issued by Paxos Trust Company on behalf of PayPal. It is available on Ethereum (ERC-20) and Solana (SPL) and is backed by cash and short-term US treasuries with regular reserve attestations. PYUSD is optimized for payments and P2P transfers, as well as being transferable on-chain for use in Web3. The contract includes compliance controls.

Issuer: PYUSD is issued by Paxos Trust Company, a regulated New York trust company.

Backing: The token is designed to be fully backed 1:1 by U.S. dollar cash and cash-equivalent assets (e.g., short-duration Treasuries).

Peg mechanics: Paxos mints new PYUSD when dollars are deposited and redeems at $1 when holders request fiat, helping keep market price near par.

Transparency: Paxos publishes independent reserve attestations so circulating supply can be compared to held reserves.

Compliance: As a regulated issuer, Paxos can apply contract-level controls (e.g., freeze under lawful order). Inside PayPal/Venmo, normal KYC/AML rules also apply.

The practical takeaway: PYUSD behaves like a tokenized dollar with mint/redeem plumbing behind it, rather than a purely market-priced crypto asset.

Chains: PYUSD exists on Ethereum (ERC-20) and Solana (SPL).

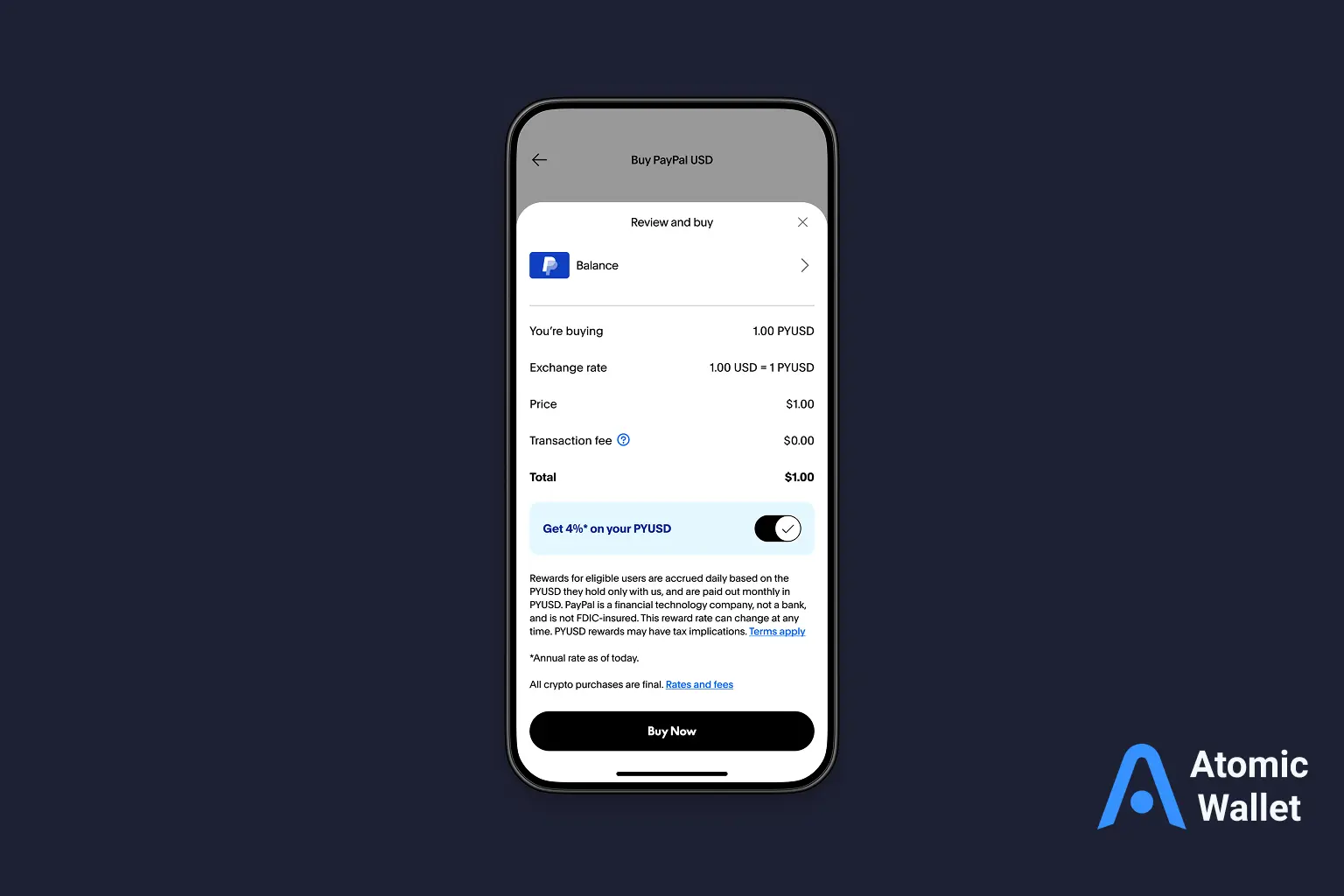

Wallets: You can keep PYUSD in PayPal/Venmo (custodial) or self-custody it in any compatible wallet. If you prefer owning the keys, store and move PYUSD alongside BTC/ETH in a non-custodial wallet like Atomic Wallet.

Transfers & dApps: On public chains, PYUSD works anywhere ERC-20/SPL are supported - DEXs, payments, settlements, and integrations where liquidity is available.

Fees:

Bottom line: hold it where it’s most convenient, withdraw to self-custody when you need open-chain portability, and factor gas vs. platform fees into your flow.

PYUSD is issued by Paxos Trust Company, a New York–regulated trust company, and is designed to be backed 1:1 by cash and cash-equivalent assets (such as short-duration U.S. Treasuries). Paxos provides regular reserve attestations by an independent accounting firm so that counterparties can check circulating supply against held reserves. As with any fiat-referenced stablecoin, residual risks include issuer and banking-partner risk, regulatory intervention, and operational events. Peg mechanism is straightforward: mint/redemption at $1 via the issuer keeps on-chain price in sync with the dollar under normal market conditions, and attestations provide transparency on backing.

PYUSD has standard compliance functionality common among regulated stablecoins. The issuer, at the behest of legal orders or internal policy, can freeze specific addresses or pause transfers (e.g., in the case of theft, sanctions compliance, or court orders). Within PayPal/Venmo - that are custodial applications - there are additional KYC/AML laws that apply.

Trade-off to understand:

If maximum censorship resistance is your top priority, weigh whether a centrally issued, fiat-backed stablecoin fits your needs.

PYUSD runs on Ethereum (ERC-20) and Solana (SPL), and you can move it between PayPal/Venmo and public blockchain addresses. In practice, you can:

Self-custody your PYUSD with Atomic Wallet - support for Ethereum & Solana, in-app swaps, and private keys that never leave your device. Download Atomic Wallet.

Issuer/contract controls: As a regulated asset, PYUSD can be frozen or blacklisted under lawful orders. This is standard for many compliant stablecoins but may not fit every user’s preferences.

Network congestion: On Ethereum, gas fees can spike. Solana fees are typically lower but depend on network conditions.

Counterparty/operational risk: You rely on Paxos’ reserve management and operations. Mitigate by monitoring attestation reports and using reputable venues.

Regulatory perimeter: Availability and features can vary by jurisdiction; some users may face KYC/AML requirements or product restrictions.

All three aim to track $1, but their trade-offs differ:

If you need PayPal/Venmo native flows, PYUSD is the obvious fit. If your priority is maximum multi-chain liquidity, USDC/USDT may currently offer more venues. Many users hold more than one to cover different rails.

If you value mainstream distribution and a clear redemption model, PYUSD is compelling. If your priority is deep, cross-ecosystem liquidity today, you may complement it with USDC/USDT.

If you are moving PYUSD on-chain, treat it as you would any other dollar stablecoin. Use a reputable, non-custodial wallet; double-check that you’re adding the official PYUSD contract on the right network (ERC-20 on Ethereum or SPL on Solana). Keep a small balance of the network’s native token for fees (ETH or SOL). For larger balances, enable hardware-wallet protection, store seed phrases offline, and consider splitting funds across multiple addresses. When interacting with dApps, review approvals and periodically revoke unused spending permissions.

Is PYUSD fully backed?

PYUSD is issued by Paxos as a regulated stablecoin; backing and attestation details are published by the issuer. Always review the latest disclosures before holding material amounts.

Which networks does PYUSD support?

PYUSD exists on Ethereum (ERC-20) and Solana (SPL). Make sure you select the correct network when sending or withdrawing.

Can PYUSD be frozen?

Like many centrally issued stablecoins, PYUSD includes compliance controls that can freeze or blacklist funds under lawful orders. Factor this into your risk model.

How do I redeem PYUSD for dollars?

Inside PayPal/Venmo you can convert PYUSD ↔ USD at quoted rates. Paxos also supports mint/redeem flows for eligible, verified customers under its compliance framework.

What fees will I pay?

On PayPal/Venmo, fees follow their schedule. On-chain, you pay network gas (ETH or SOL) plus any exchange/DEX fees if you trade.

Is PYUSD “better” than USDC or USDT?

It depends on your use case. PYUSD integrates tightly with PayPal/Venmo; USDC/USDT currently have broader multi-chain liquidity. Many users hold more than one.

PYUSD introduces a mainstream on-ramp (Venmo/PayPal) to a tokenized dollar that also moves on public chains. If you require fast, friendly fiat conversions and open-chain portability for payments or DeFi, it's a handy tool to have in your kit. For optimal control, self-custody PYUSD and follow normal operational security best practices: verify contracts, keep backups offline, and review permissions.

Take full control of your PYUSD. Hold, swap, and track it alongside ETH/SOL in Atomic Wallet with true self-custody. Get Atomic Wallet and keep your dollars on-chain - securely.

Learn what Aztec Network is, how its privacy Layer 2 works, and what the AZTEC token launch means. Explore AZTEC staking, programmable privacy, and how Aztec differs from other Ethereum L2s.

DigiDollar is a decentralized USD stablecoin built on DigiByte, using time-locked overcollateralized DGB for non-custodial liquidity. Now on testnet.

Explore the most active and profitable Polymarket categories in 2026. Learn how politics, sports, crypto, AI, and macro markets differ by liquidity, volatility, and risk — and why category choice matters as much as prediction.