Assets

Exchange

Buy Crypto

Products

Payment-first blockchains are once again in focus. These larger stablecoin volumes mean rails that need to be as frictionless as card networks. Consumer apps demand sub-second checkout for retail and remittances. Merchants are not so interested in throughput records but do desire predictable fees.

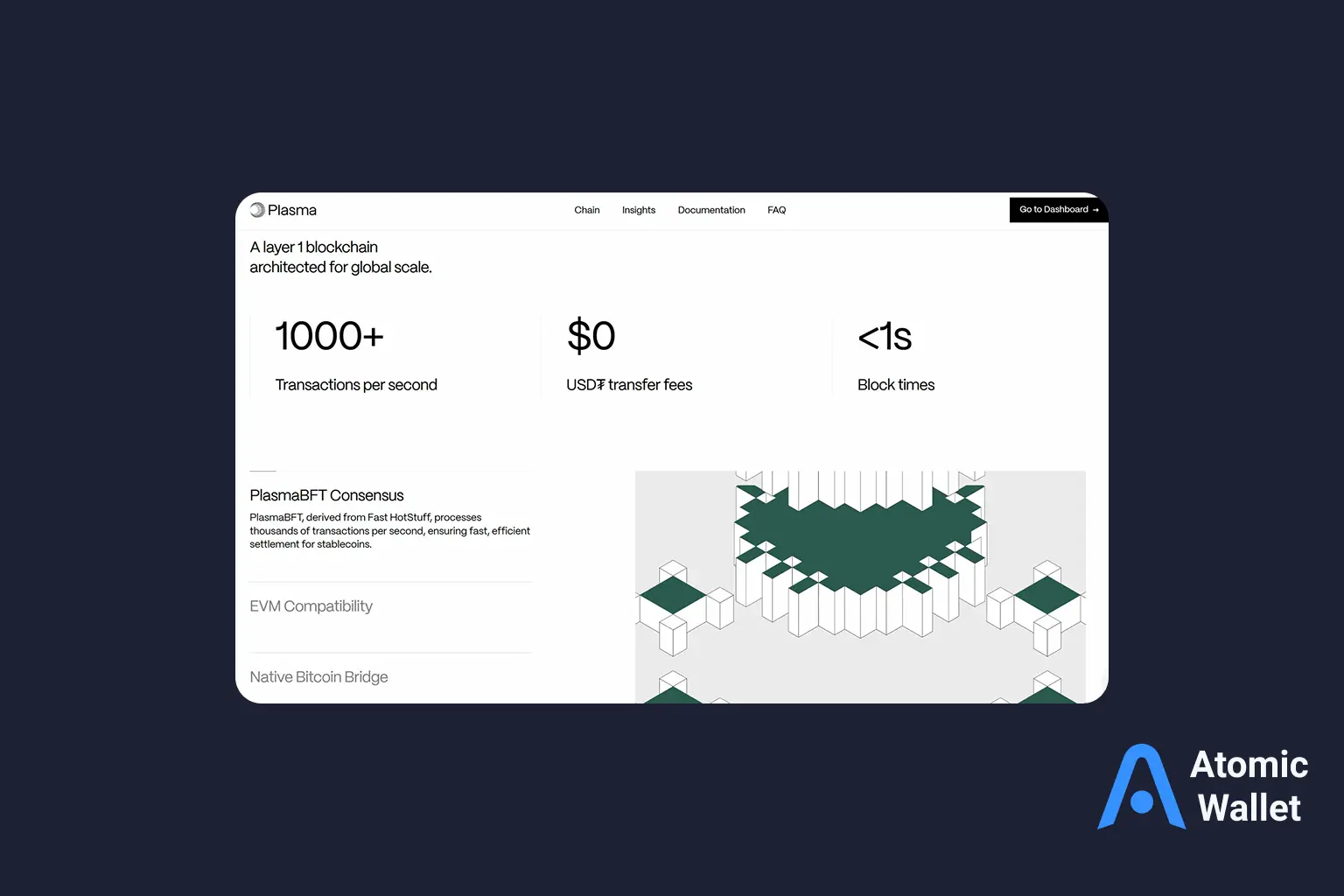

Plasma (XPL) enters this space as a payment-optimized Layer-1. The goal is not to chase all DeFi use cases but to make everyday transactions self-custodied, trustworthy, and instantaneous.

Plasma puts the scope of the blockchain on payments. While Ethereum and Solana emphasize programmability and high-throughput DeFi, XPL specializes in:

The network architecture uses rapid block creation, pipelined execution to avoid congestion bursts, and a consensus protocol with single-round finality as the goal. It presents to developers a minimal set of primitives: token contracts, payment APIs, and refund/receipt hooks.

The philosophy is straightforward: make on-chain payments inexpensive, predictable, and easy - at a scale that is useful to consumers and companies alike.

Plasma is built to prioritize payments above everything else. Instead of feature bloat, it's built on top of a few cutting-edge features that make a real difference in practice:

This approach characterizes Plasma: it's not trying to be the "everything chain," but the payments-first chain.

The XPL token powers the Plasma ecosystem.Its functions are kept to a minimum to keep the system aligned and secure:

Emission schedules and circulating supply are not publicly available at the time of writing. Always refer to Plasma's public announcements for token details.

Plasma's ecosystem is nascent but growing. Focus areas currently include:

The roadmap had promised utilitarian adoption: not hype DeFi speculation, but actual-world usage by enterprises and consumers.

Plasma is intentionally targeted: it wishes to own payments, not enable every type of dApp. Even within that target, nevertheless, use cases are broad:

In contrast to chains that are trying to "do everything," Plasma use cases are focused on smoothing money flow.

There is no blockchain without risk, and Plasma is no different. The protocol is novel, so at scale, consensus mechanisms and throughput aspirations are relatively stress-tested little. Token distribution can create volatility should dumps on early emissions or unlocks spill onto the market. Regulatory scrutiny is a further factor: payment rails receive more attention than broader DeFi platforms, and policy changes could affect usage. Finally, custodial partners and bridges add a layer of operational risk that users have to navigate carefully.

If you look at the broader ecosystem of payment-oriented blockchains, there are some names that always come up. Solana, for example, is blessed with its raw throughput but still suffers from intermittent downtime. Stellar carved out its beachhead in cross-border remittances, but programmability falls behind more modern L1s. Celo carved out a mobile-first presence, and Base has Coinbase's regulatory posture and fiat on-ramps to draw upon.

Plasma's potential is otherwise: it's built from the ground up for payment and settlement, and fees and latency are the governing design constraints. The trade-off is that it may not chase every DeFi use case on day one - but for merchant partners and fintech partners, that focus may be its market differentiator.

XPL can be traded on both centralized and decentralized platforms. Always verify listings against official Plasma channels to avoid contract impersonations.

Buying options:

Storing XPL:

Secure XPL in a trusted non-custodial wallet like Atomic Wallet, where you control your keys.

XPL holders can possibly stake and be involved in governance. A few details are not yet publicly available, so rely on official documentation for the most current information.

Staking:

Governance:

What is Plasma (XPL) used for?

Primarily for fast, low-cost payments and settlements between users, merchants, and fintechs.

What is the XPL token used for?

Pays for transaction fees, enables staking/validator security, and is used for governance decisions.

How do I get XPL?

Via listed exchanges (following confirmation) or through supported DEXs. Always confirm contract addresses from official sources.

Can I stake or delegate XPL?

Yes - staking is part of network security, with delegation an option for users who do not want to run validators directly.

How does Plasma differ from other payment blockchains?

Its design focus is speed and affordability of payments, but still offering programmability beyond simple transfers.

Learn what StakeShark is and how non-custodial staking validators work. Understand PoS delegation, slashing risks, uptime, supported networks, and how to stake crypto securely.