Assets

Exchange

Buy Crypto

Products

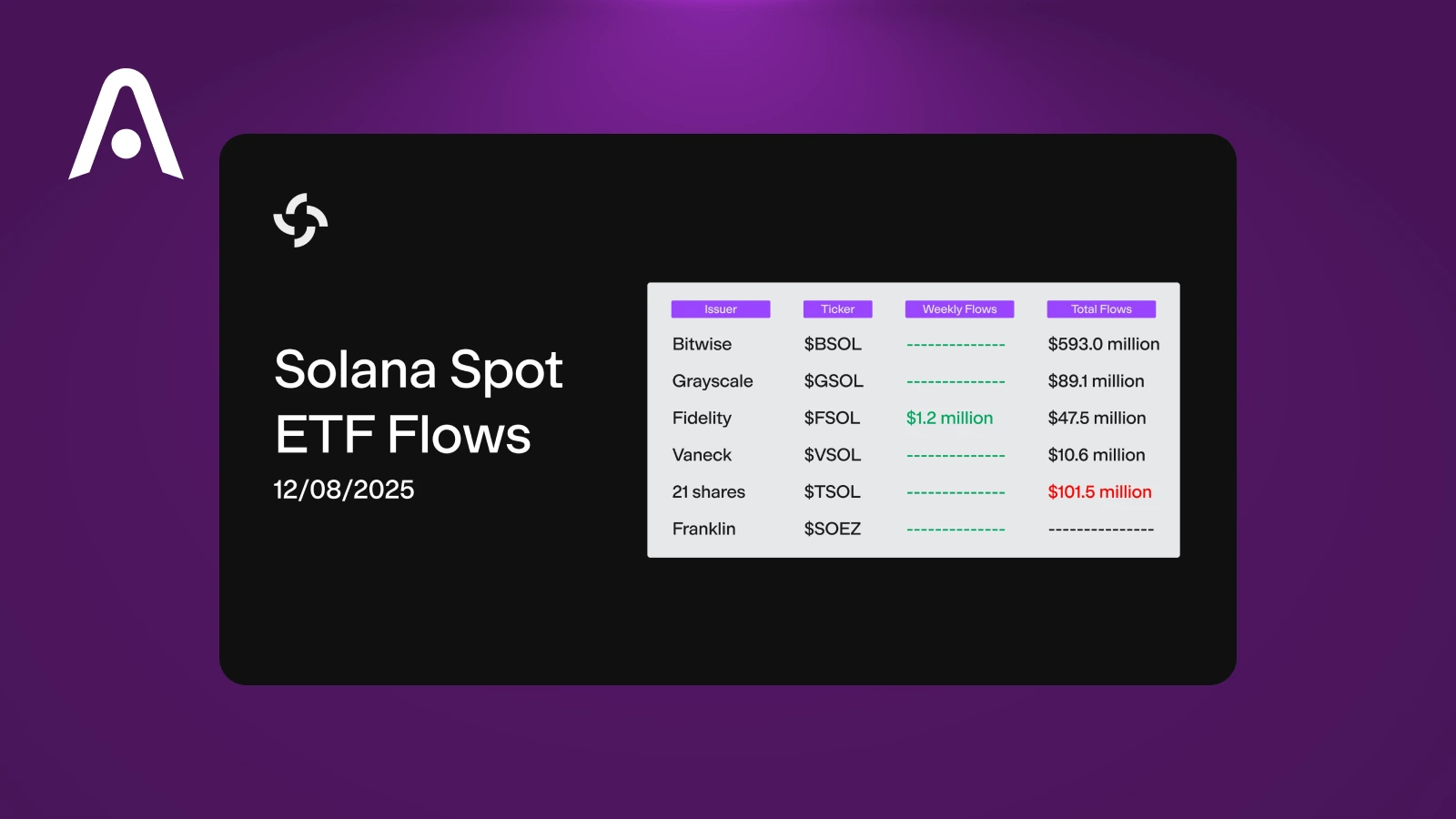

Solana has moved from “high-beta altcoin” to a core part of the crypto conversation, so it’s no surprise investors are now asking about Solana ETFs. After the success of spot Bitcoin ETFs and growing interest in Ethereum products, attention is shifting to SOL as the next candidate for regulated exposure. For traditional investors who don’t want to deal with wallets, private keys, or exchanges, a Solana ETF is the bridge between fast-growing on-chain activity and a familiar brokerage account.

This guide is designed as a practical field overview: what a Solana ETF is, how these products work under the hood, who they might suit, how they can fit into a broader portfolio, and what risks and tax nuances you need to understand before jumping in.

A Solana ETF is an exchange-traded fund designed to give investors price exposure to SOL, the native asset of the Solana blockchain, through a traditional stock-market vehicle. Instead of buying and holding SOL in a crypto wallet, you buy shares of the fund on a regular brokerage platform, and the fund’s value is meant to track the market price of Solana.

In practice, different Solana ETFs can be structured in different ways, but most fall into one of two broad categories:

Compared to buying SOL directly, a Solana ETF wraps that exposure in a regulated, familiar format: ticker symbol, stock exchange listing, and standard brokerage access, but without self-custody, DeFi usage, or direct interaction with the Solana network.

A Solana ETF is built to mirror the market price of SOL while operating within the traditional ETF creation/redemption system. Even though each issuer structures the product slightly differently, most follow a similar framework:

First, the ETF calculates its NAV (Net Asset Value) based on the current spot price of SOL. Authorized participants (APs) — typically large financial institutions — can create or redeem ETF shares to keep the price aligned with NAV. When demand increases, APs deliver cash or assets to the fund in exchange for new ETF shares; when demand falls, they redeem shares back for underlying assets. This mechanism is what helps the ETF remain closely tied to SOL’s real-time price, even during periods of high volatility.

Key components typically include:

In short: a Solana ETF abstracts away wallet management and blockchain interaction, delivering price exposure through a familiar, regulated wrapper.

Solana’s surge in institutional relevance isn’t accidental. Over the last two years, SOL has consistently been one of the best-performing major layer-1 assets, driven by increasing throughput, Firedancer upgrades, strong DeFi volumes, and a rapidly growing app ecosystem. This momentum has pushed funds, analysts, and wealth managers to begin treating Solana not merely as an altcoin, but as a viable part of smart-contract infrastructure portfolios.

Recent 13F filings — quarterly disclosures from large U.S. investment managers — already show early forms of Solana exposure through structured notes, ETPs, and international Solana products. Meanwhile, European Solana ETPs have recorded steady inflows as demand shifts from speculative trading to long-term thematic exposure.

For institutions, Solana represents a “high-beta smart contract play”: higher volatility than ETH, but potentially higher upside due to ecosystem growth. That narrative is a key reason Solana ETF proposals have gained traction.

A Solana ETF isn’t for everyone — and that’s exactly the point. These products are meant for investors who want exposure to SOL without having to buy, store, or manage crypto directly. They are particularly suitable for:

If self-custody feels intimidating or out of scope, a Solana ETF provides a clean, regulated alternative.

A Solana ETF can slot into a portfolio in several ways, depending on an investor’s risk tolerance and asset allocation strategy. Because SOL historically behaves as a high-beta asset—moving more aggressively than BTC or ETH—it’s typically treated as a growth satellite rather than a core holding. For portfolios already containing Bitcoin or Ethereum exposure, a Solana ETF can add diversification across smart-contract ecosystems while maintaining the convenience of traditional brokerage accounts.

Possible allocation frameworks include:

Because SOL tends to correlate with BTC, ETH, and even NASDAQ tech stocks during macro cycles, the key is balancing potential returns with market swings. A Solana ETF simplifies access while keeping risk management within the traditional asset-allocation toolbox.

Even with strong institutional interest, Solana ETFs come with their own set of considerations. The biggest risk is simply Solana’s inherent volatility: price moves can be dramatic, especially during periods of network-level hype or stress. Additionally, unlike holding SOL directly, ETF investors do not receive staking rewards, which can be a meaningful part of Solana’s native yield profile.

Other risks include:

A short rule of thumb: a Solana ETF is regulated and convenient, but not inherently “safer” than SOL — the underlying volatility is the same.

Solana ETFs represent the next phase of mainstream crypto adoption, giving investors regulated, brokerage-friendly access to one of the fastest-growing Layer-1 ecosystems. They remove the complexity of wallets, custody, and on-chain management while still offering exposure to SOL’s performance. With institutions increasingly reporting SOL positions in 13F filings and global ETPs seeing steady inflows, the foundation for a broader Solana ETF market is already forming.

As the ecosystem expands—Firedancer, higher throughput, rising developer activity—ETF demand may amplify the Solana narrative even further.

A Solana ETF isn’t a replacement for holding SOL directly, but it’s a powerful new option for traditional investors who want structured access to the asset class.

If you prefer direct exposure, Atomic Wallet lets you securely self-custody SOL and explore the entire Solana ecosystem—from SPL tokens to DeFi apps—without intermediaries.

You stay in full control of your keys while managing and swapping assets in one place.

Learn how the MetaMask Card works with Mastercard, how self-custody crypto spending differs from prepaid cards, and what it means for mainstream crypto payments in the US.